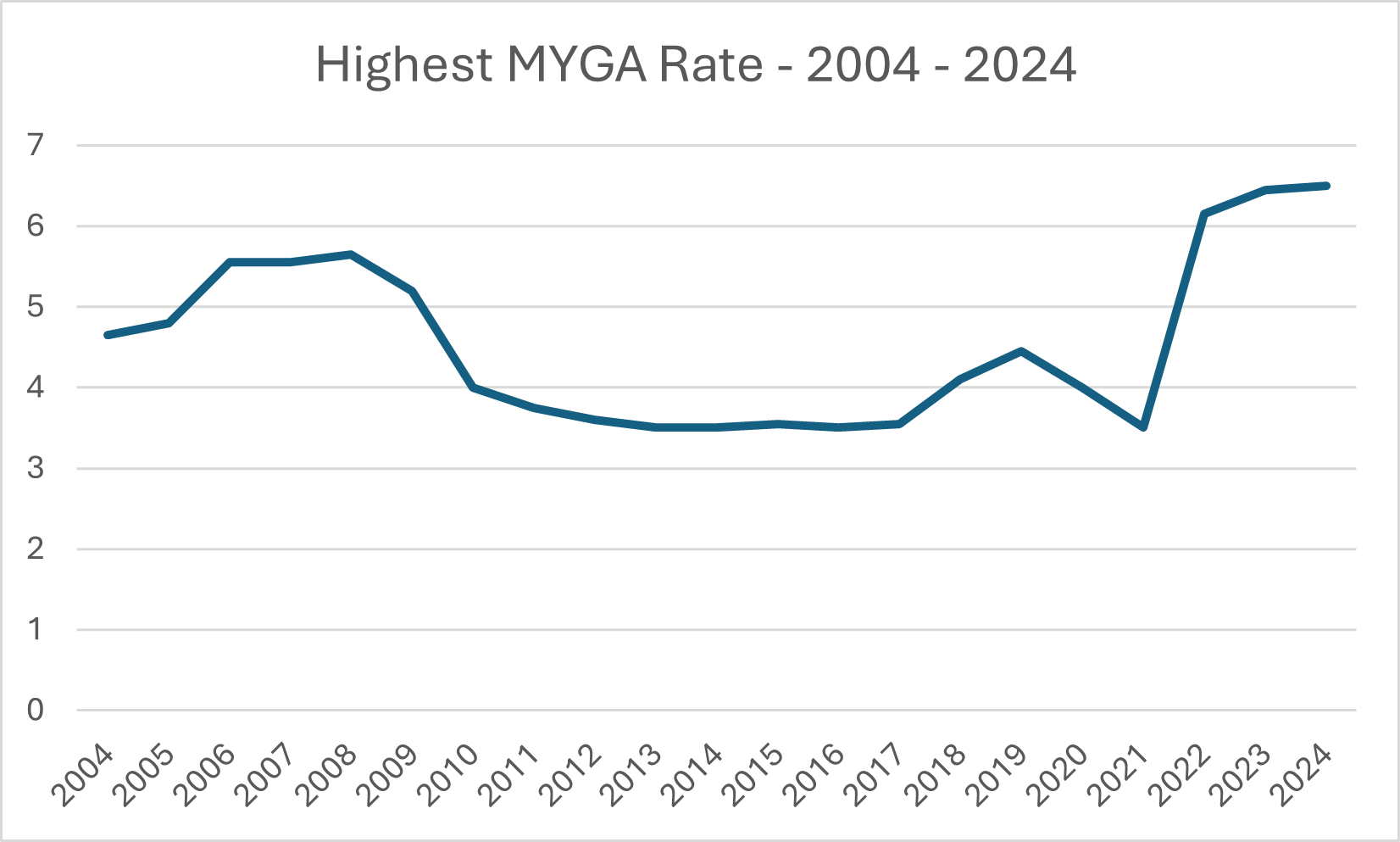

As the Fed holds short-term rates above 5% to combat inflation, the rates on 5-year fixed annuity rates have likewise remained historically high since mid-2023. Is this window of opportunity about to close?

Before this recent period, the last time 5-year fixed annuity rates were above 5% was nearly 15 years ago.

The Federal Reserve is now projecting a gradual year-over-year decrease in interest rates until they moderate to 2.80% in 2027.1

| Dec. 2023 | 2024 | 2025 | 2026 | 2027 | |

| Federal Funds Rate FOMC Projections | 5.40% | 5.10% | 4.10% | 3.10% | 2.80% |

Have Interest Rates Reached Their Peak?

As rates move lower, those saving for retirement will likely earn less on their conservative financial assets such as money market accounts, bonds, CDs, and savings accounts. Over the past couple of years, average rates on fixed-rate annuities have risen from 4.24% in November 2022 to a peak of 4.94% in December 2023 before dipping to 4.64% in April 2024.2

5-Year Multi-Year Guarantee Annuity (MYGA) Average Rates

Capture Higher Rates Now

Locking in a higher rate for a longer period amid projected lower interest rates by the Federal Reserve may be a prudent financial strategy. In an environment of declining interest rates, this approach offers stability, predictability, and the potential of a more favorable interest accumulation, helping to provide a secure foundation for long-term financial goals.

1 Summary of Economic Projections, FederalReserve.gov

2 AnnuityRateWatch.com